財務(wù)柔性、社會責(zé)任與公司績效

肖珊珊 彭曉蓮

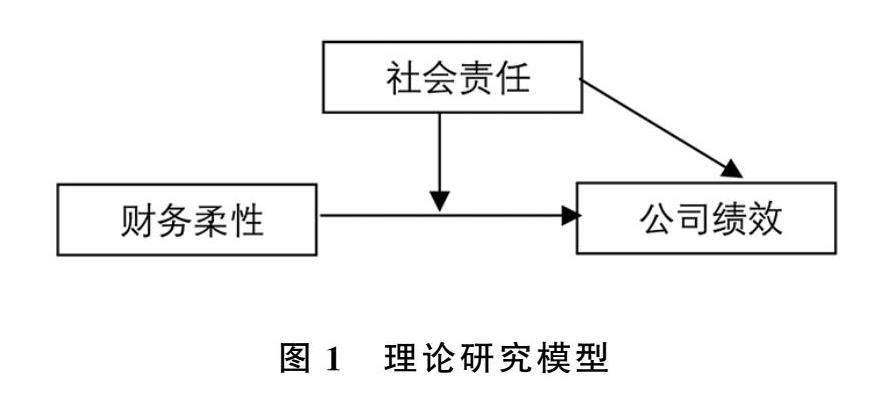

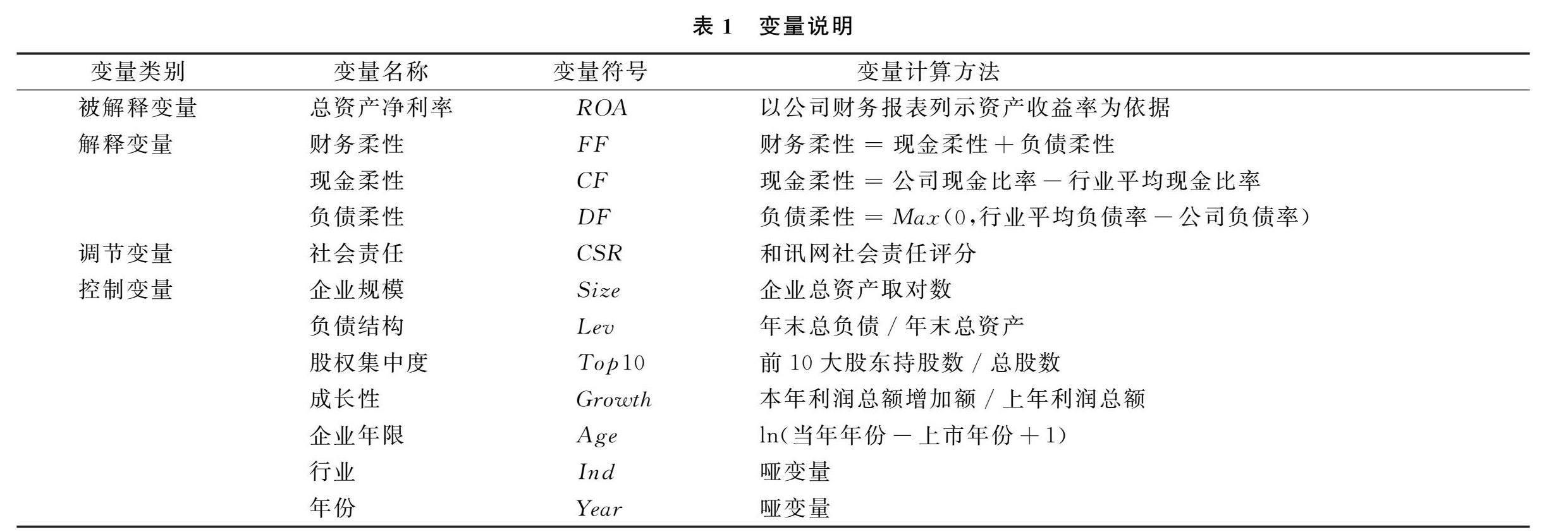

摘?要:財務(wù)柔性具有的“預(yù)防”和“利用”兩大屬性,與公司績效息息相關(guān)。以上證主板2013-2022年數(shù)據(jù)為研究樣本,運(yùn)用Stata軟件對財務(wù)柔性、企業(yè)社會責(zé)任與公司績效之間的關(guān)系進(jìn)行實證檢驗,研究發(fā)現(xiàn)財務(wù)柔性對公司績效的影響呈倒“U”型關(guān)系;社會責(zé)任有利于公司績效的提升;財務(wù)柔性與社會責(zé)任的交乘項在1%的水平上對公司績效產(chǎn)生顯著的正向影響,表明社會責(zé)任會強(qiáng)化財務(wù)柔性“雙刃劍”的特點。因此企業(yè)需要精確掌握財務(wù)柔性的閾值,充分利用社會責(zé)任對財務(wù)柔性的正向調(diào)節(jié)作用,助力公司績效提升。

關(guān)鍵詞關(guān)鍵詞:財務(wù)柔性;社會責(zé)任;公司績效

中圖分類號中圖分類號:

F562.6;F560.68;F270

文獻(xiàn)標(biāo)識碼:A

DOIdoi:10.3969/j.issn.1672-2272.202403160

英文標(biāo)題Financial Flexibility, Social Responsibility and Company Performance:An Empirical Study Based on the Shanghai Stock Exchange Main Board

Xiao Shanshan,Peng Xiaolian

(School of Economics and Trade, Hunan University of Technology, Zhuzhou 412000, China)

英文摘要Abstract:The two attributes of “prevention” and “utilization” of financial flexibilit-y are closely related to enterprise performance. In this article, the above A-share data from 2013 to 2022 is a research sample. The stata software is used to empir-ically test the relationship between financial flexibility, corporate social responsibility and enterprise performance. The study found that the impact of financial flexib-ility on enterprise performance presents an inverted “U” relationship; social respon-sibility is conducive to corporate social responsibility and enterprise performance. The study found that the impact of financial flexibility on enterprise performance presents an inverted “U” relationship; social responsibility is conducive to corporat-e performance. The improvement of efficiency; the multiplication of financial flex-ibility and social responsibility has a significant positive impact on enterprise perf-ormance at the level of 1%, indicating that social responsibility will strengthen th-e characteristics of financial flexibility. Therefore, enterprises need to accurately g-rasp the threshold of financial flexibility, make full use of the positive adjustment of social responsibility on financial flexibility, and help improve performance.

英文關(guān)鍵詞Key Words:Financial Flexibility; Social Responsibility; Corporate Performance

0?引言

隨著市場競爭的加劇和經(jīng)濟(jì)全球化的深入發(fā)展,國內(nèi)企業(yè)正面臨著日益復(fù)雜和多變的外部環(huán)境。在這種情況下,企業(yè)需要增強(qiáng)財務(wù)柔性以應(yīng)對市場波動、風(fēng)險挑戰(zhàn)和不確定性因素。具備良好財務(wù)柔性的企業(yè)能夠更好地抵御外部沖擊,保持盈利能力和穩(wěn)健經(jīng)營,降低金融風(fēng)險。因此,研究企業(yè)財務(wù)柔性不僅可以為企業(yè)提供應(yīng)對挑戰(zhàn)的有效策略,還有助于促進(jìn)企業(yè)的穩(wěn)健經(jīng)營和可持續(xù)發(fā)展。這些經(jīng)濟(jì)背景下的需求使得企業(yè)財務(wù)柔性成為當(dāng)前經(jīng)濟(jì)管理領(lǐng)域的研究熱點。

1?文獻(xiàn)綜述

1984年,美國財務(wù)會計準(zhǔn)則委員會(FASB)最早提出了“財務(wù)柔性”一詞,認(rèn)為財務(wù)是采用有效措施來改變現(xiàn)金流的數(shù)量和時間分布,以應(yīng)對不確定性需求和機(jī)會的能力。……

- 科技創(chuàng)業(yè)月刊的其它文章

- 企業(yè)數(shù)字化轉(zhuǎn)型對組織韌性的影響:知識整合能力的中介和冗余資源的調(diào)節(jié)效應(yīng)

- 體育創(chuàng)業(yè)者勝任力階梯模型構(gòu)建

- 創(chuàng)業(yè)政策認(rèn)知對大學(xué)生返鄉(xiāng)創(chuàng)業(yè)意愿的影響

- 主觀規(guī)范與創(chuàng)業(yè)意愿:基于家庭規(guī)模和政治聯(lián)結(jié)的解釋

- 我國跨境電商企業(yè)創(chuàng)新績效提升組態(tài)路徑研究

- 優(yōu)勢型領(lǐng)導(dǎo)對員工創(chuàng)造力的促進(jìn)機(jī)制研究