小微企業融資渠道選擇及其影響因素實證分析

張蘊暉+董繼剛

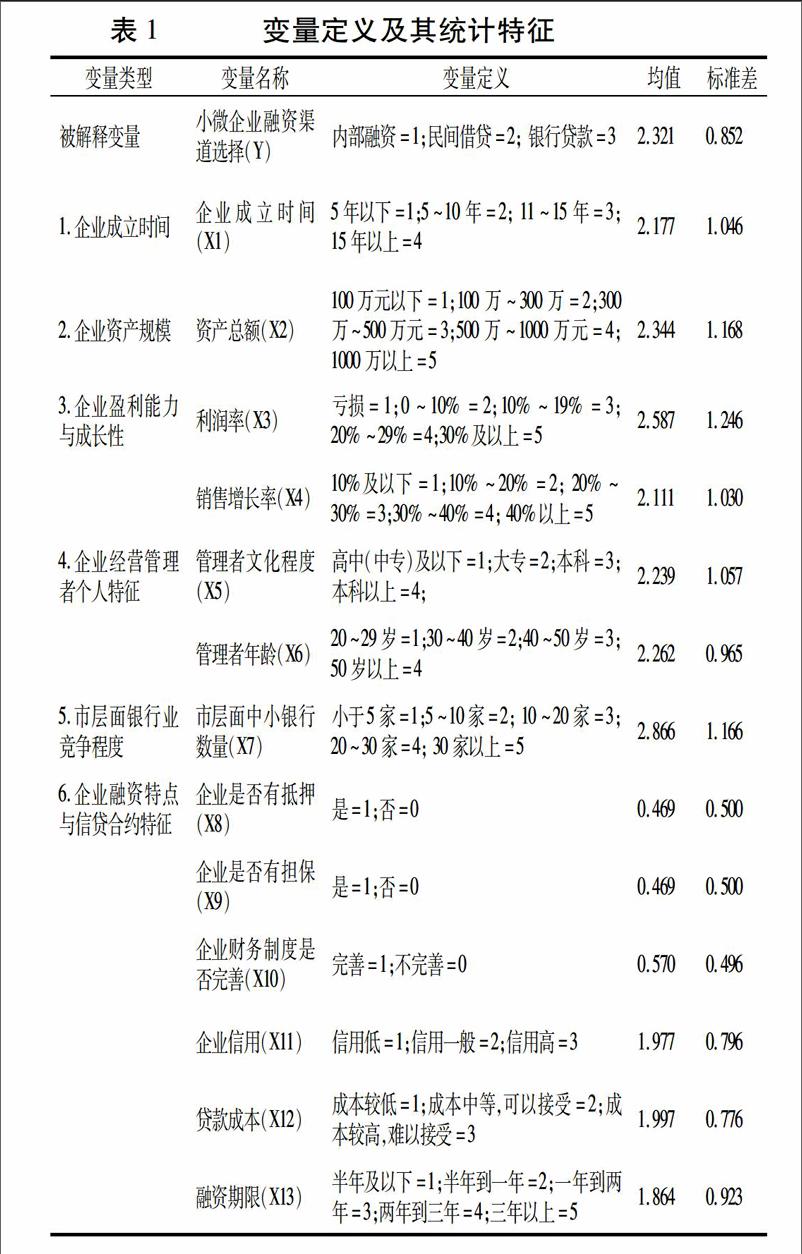

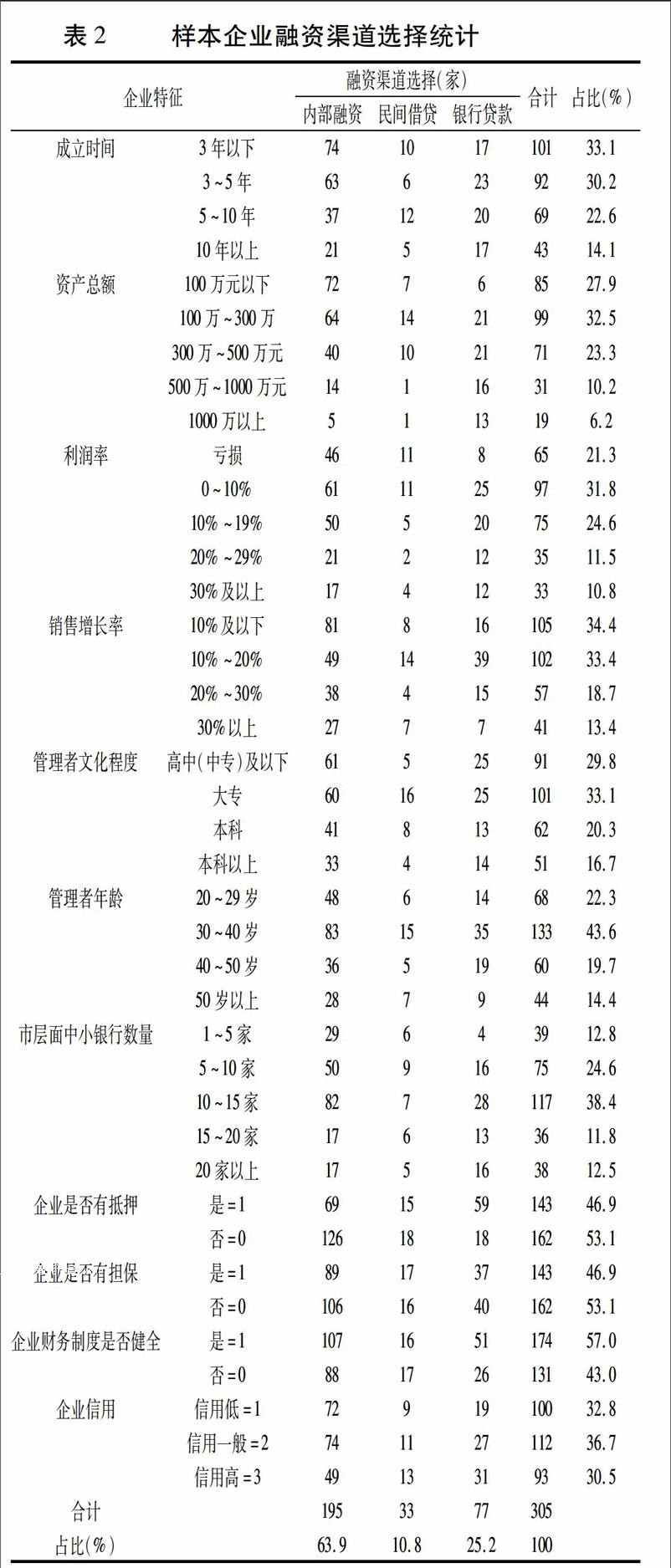

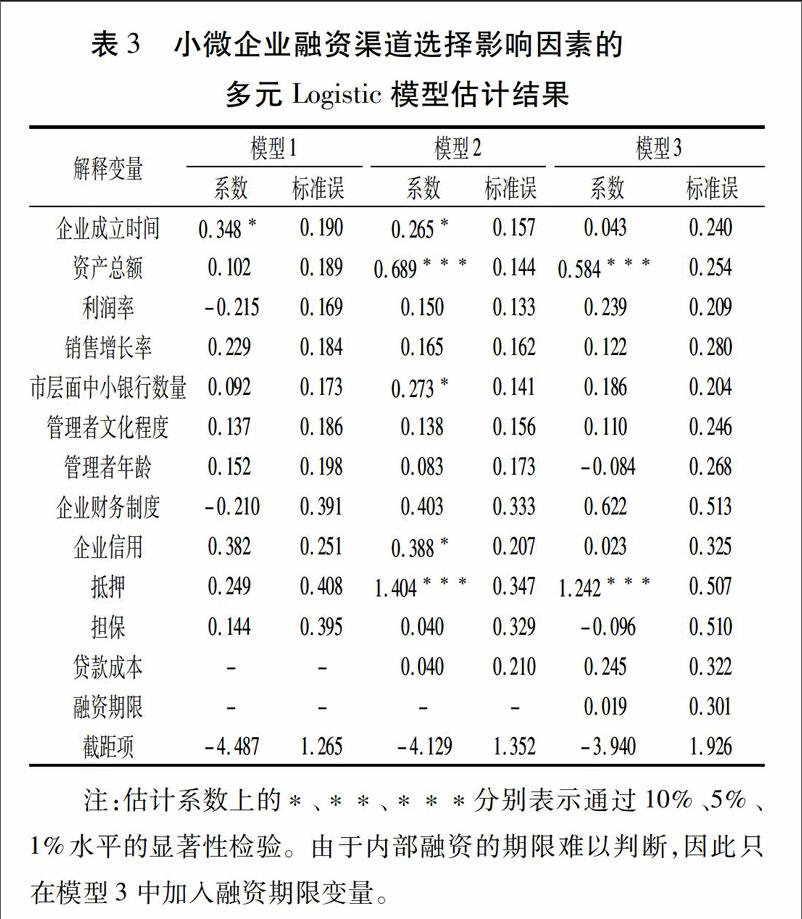

摘要:依據山東省小微企業的調研數據,采用多元 Logistic 模型對小微企業融資渠道選擇行為的影響因素進行了實證分析。結果表明:多數小微企業資金來源主要依賴內部融資;銀行貸款是小微企業主要的外部融資渠道;當小微企業成立時間越長、資產規模越大、信用狀況越好、擁有有效抵押物以及市層面中小銀行數量越多時,越傾向于選擇銀行貸款的融資方式。

關鍵詞:小微企業;融資渠道;影響因素;多元Logistic模型

中圖分類號:F324文獻標識號:A文章編號:1001-4942(2017)11-0157-05

Empirical Analysis on Choice of Financing

Channels of Small and Micro Enterprises and Its Influencing

Factors Based on Survey Data of Shandong Province

Zhang Yunhui, Dong Jigang

(College of Economics and Management, Shandong Agricultural University, Taian 271018, China)

AbstractBased on the survey data of small and micro enterprises in Shandong Province, we used the multivariate logistic regression model to conduct empirical analysis on factors influencing their choice of financing channels. The results showed that the source of funding of most small and micro enterprises mainly relied on self-funding, and bank loans were the main external financing channels. This research also found that small and micro enterprises with longer life-span, larger asset size, better credit status, effective collaterals and more small- and medium-sized banks at the city level were inclined to choose bank loans for financing.

KeywordsSmall and micro enterprises; Financing channels; Influencing factors; Multivariate logistic regression model

我國約有小微企業7 000萬家,在提供就業崗位、維持社會穩定和促進經濟增長等方面發揮著重要作用,然而融資渠道受限、融資難的問題長期困擾著小微企業,成為制約其生存和發展的主要原因。

學者對小微企業融資渠道的劃分和融資渠道選擇的影響因素進行了大量研究。田秀娟(2009)[1]把融資渠道分為正規融資渠道和非正規融資渠道。梁琦等(2005)[2]認為我國中小企業在創業、生存和成功三個階段分別依賴自有資金、商業信用和民間借貸。周月書等(2009)[3]認為企業年齡、規模和盈利能力是影響中小企業融資決策的主要因素。許立民(2010)[4]實證研究表明資產規模、財務制度是否健全以及產品銷售是否穩定是影響中小企業融資渠道選擇的主要因素。張揚(2012)[5]通過實證分析得出,企業規模、成立時間、法人學歷等因素與農村中小企業選擇正規金融渠道融資呈正相關。唐文萍(2013)[6]實證分析發現,中小微企業資本結構以自有資金為主,外部融資以銀行貸款為主,民間借貸是外部融資的重要補充。……