APRIL 2020

by Cotton Incorporated

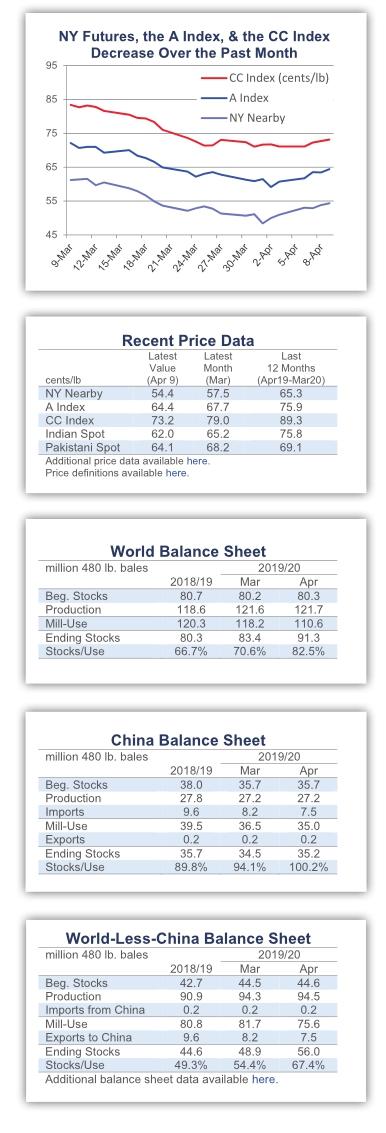

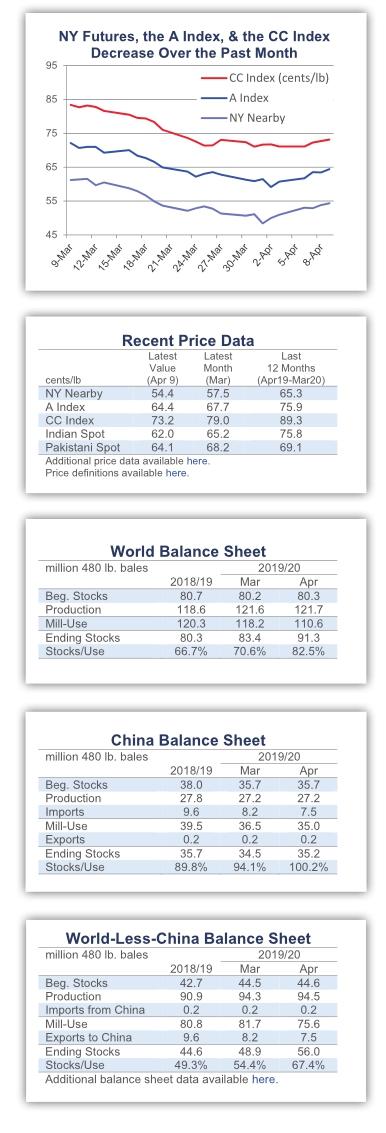

Recent price movement

All benchmark prices fell over the past month.

The nearby May NY futures contract dropped from 61 to 53 cents/lb.

The A Index slipped from 72 to 64 cents/lb.

In international terms, the China Cotton Index (CC Index 3128B) decreased from 85 to 72 cents/lb. In domestic terms, prices eased from 13,000 to just below 11,200 RMB/ton. The RMB weakened slightly against the dollar, from 6.95 to 7.06 RMB/USD.

Indian cotton prices (Shankar-6 quality) dipped from 67 to 63 cents/lb. In domestic terms, values fell from 38,900 to 37,000 INR/candy. The Indian rupee weakened slightly from 74 to 76 INR/ USD.

Pakistani prices decreased from 70 to 64 cents/lb over the past month. In domestic terms, values fell from 9,000 to 8,800 PKR/maund. The Pakistani rupee weakened from 154 to 168 PKR/USD.

Supply, demand, & trade

With the rapid spread of COVID-19, the latest USDA report featured a record downward adjustment to demand. Global milluse was lowered 7.6 million bales relative to last month (to 110.6 million). If realized, this would be the lowest level since 2013/14(due to the price spike, mill-use was below 110 million bales between 2011/12 and 2013/14). Uncertainty is high. Given the possibility for the disease to re-emerge after an initial containment and the severe economic effects resulting from shutdowns around the world, further downward revisions appear likely.

Country-level reductions for consumption were widespread. The largest decreases were for India (-2.5 million to 22.0 million bales), China (-1.5 million to 35.0 million), Pakistan (-700,000 to 10.1 million), Bangladesh (-500,000 to 6.9 million), Turkey (-500,000 to 6.8 million), Vietnam (-500,000 to 6.3 million), Indonesia(-200,000 to 2.8 million), and Uzbekistan(-150,000 to 3.2 million). There were also a large number of decreases of 100,000 bales (Brazil, Mexico, the U.S., and Thailand) or less.

The world production estimate was comparatively unchanged (+118,000 bales to 121.7 million) and was primarily a result of a 200,000 bale increase for Brazil (to 13.2 million). With the large decrease in mill-use an increase in production, there was a large (7.9 million bale) increase in world ending stocks. At 91.3 million bales, the current forecast calls for the biggest carryout since 2014/15. In 2014/15, global stocks were concentrated in Chinas reserve program. A defining element of the reserve program at that time was its withholding of stocks from the market. That withholding prevented the high level of stocks from fully weighing on prices. With no government support on the scale that China provided from 2011/12 to 2014/15 expected this crop year, the burden of 2019/20 stocks can be expected to keep significant downward pressure on prices.

Price outlook

The specter of the COVID-19 pandemic dominates life around the world. Cases appear to have peaked in China, South Korea, a few countries in Europe, but counts continue to climb in the U.S. and most other countries. The health crisis remains at the forefront, but as more of the world starts to move beyond the scare stemming from the disease, the economic symptoms resulting from widespread shutdowns will begin to be more fully confronted.

As is often the case in recessions, financial concerns are central. With revenue and incomes pulled sharply lower, businesses and consumers need credit to bridge them through. At the same time, banks are looking at the economic environment and see an increased risk of default. This can make banks more reluctant to lend at the same time that businesses and consumers may be most desperate. To help unlock the vicious spiral of worsening economic conditions and contracting credit, central banks and governments around the world have moved to stimulate lending and guarantee income.

This is certainly true in the U.S., where the Federal Reserve lowered interest rates to the lowest level on record (matching lows after the 2008/09 financial crisis) and the government approved a record spending package. Emerging markets, where much of the worlds textile manufacturing capacity is concentrated, are more limited in the actions that their central banks and governments can take. As a result, the consequences of shutdowns may be more severe in countries that are important for global textile production.

A common strategy among companies in downturns is to restrain spending and preserve cash. This can mean lean inventories when the eventual recovery arrives. After the financial crisis of 2008/09, low manufacturers and retailer inventories were paired with a surge in demand as economic conditions began to improve. The combination resulted in the 2010/11 spike in cotton prices. The sudden onset of the current crisis means that we are still in the early stages of inventory drawdown. After the health threat subsides and business activity picks up, a surge in demand through emptied supply chains could be anticipated.

Unlike the recovery that followed the last global recession, cotton fiber supplies should be plentiful in the recovery that eventually surfaces. Due to high prices for corn and soybeans and low prices for cotton, global cotton acreage and production declined successively in the three years before the spike. This caused the global stocks-to-use ratio to drop to below 40% in 2009/10. In contrast, the current stocks-to-use ratio for 2019/20 is 83%, indicating more than double the level of available supply relative to use (and use estimates may fall further).

The USDA will release its first full set of estimates for the 2020/21 crop year next month. USDA planting estimates for the U.S. released at the end of March, suggested U.S. acres would be nearly unchanged yearover-year. If a similar pattern is maintained in other major producing countries for 2020/21, another major surplus could emerge next crop year. Such a surplus, when added to the high level of 2019/20 ending stocks that will be carried forward, makes the prospect of another price spike in the economic recovery that follows the current crisis appear unlikely.

Nonetheless, significant upward pressure may develop in garment sourcing costs. This upward pressure could result from competition for order completion. Competition can be expected to result from the traditional surge in demand through supply chains with lean inventories. However, the current downturn is already remarkable for the depth of its descent. Given the severity, a factor that could compound traditional price effects is that there could be fewer textile manufacturers in business to take orders. It remains to be seen what support measures may be offered to emerging markets and how many manufacturers in those countries may be forced to close. If closures are widespread, global manufacturing capacity may require several years to rebuild.

- China Textile的其它文章

- aining China International Home Textiles Cloud Expo goes live this year,launching a new“cloud”model

- Strike hard to maintain the order of the melt blown nonwovens market

- A 500K Ton/Year PET Project Breaks Ground in Korla,Bayingol Mongolia of Xinjiang

- A Glimpse of Industrial Park in Xinjiang amid Virus Fighting

- From January to March,the profits of industrial enterprises above designated size decreased by 36.7%

- Manmade fiber industry hit hard with profits fallout by 75%