China's Monetary Policy Is Less Exposed to the Federal Reserve

?

OPINION

China's Monetary Policy Is Less Exposed to the Federal Reserve

U.S. Federal Reserve Chair Janet Yellen recently changed her cautious attitude and suggested in her speech on August 26 that an increased interest rate is more likely to happen in the near future.

Since Yellen didn’t elaborate on when the Fed would raise the rate, the global market still maintains a skeptical attitude. There are three rate negotiation meetings to be held in September, November and December, thus it could happen anytime over the three months. Considering the general situation of the U.S. economy, the Fed may be most likely to raise the rate at the December meeting. Despite that, the odds of an interest rate increase are merely 50 percent.

Perhaps it reflects a lack of confidence in the U.S. economic recovery. The Fed will probably raise the interest rate once within 2016, just for the sake of raising the rate. If the Fed takes no action this year, the global market will become disillusioned about the potential growth brought about by the U.S. recovery. As revised statistics released by the U.S. Department of Commerce on August 26 show, the country’s real GDP rose 1.1 percent in the second quarter, falling short of the expected 1.2 percent. Besides that, the University of Michigan Consumer Sentiment Index unveiled the same day registered a drop for the third month straight, implying that the groundwork for economic recovery is not solid.

The good news is that risks holding back the Fed’s raise last year have disappeared. China’s stock and foreign exchange markets are heading toward stability and its supplyside reform is progressing steadily and has been deemed as a template for other countries. In addition, the risks brought about by Brexit to the U.S. and global markets are gradually fading away, while emerging markets have seen their risk-resistance capacity improved. Given all that, the Fed raising interest rates is not likely to trigger global panic. On the contrary, increasing the rate even once within the year could pluck up global confidence in the U.S. economic recovery.

However, the global market is still fraught with uncertainties. The International Monetary Fund has lowered its forecasts for global economic growth in 2016 and 2017. At the end of last year, the Fed first raised the rate. The Fed is now quite prudent, ensuring that the U.S. economy can rebound in a healthy and stable way.

While the United States has tended to stabilize economic growth by postponing interest rate increases, China has resorted to carrying out supply-side reform. Meanwhile,other major economies, more or less, continue practicing monetary easing. Japan and the EU have not given up on loose monetary policy. Recently, Japan unveiled more than 28 trillion yen ($271.8 billion) of stimulus,while Britain also joined the monetary easing club to fend off the shock of Brexit.

In contrast, China’s central bank and the Fed have stuck to their relatively prudent monetary policies. While the Fed hasn’t raised interest rates this year, the People’s Bank of China only reduced the reserve requirement ratio of commercial banks once. China has also been advancing market-oriented reform on the yuan exchange rate in order to realize the yuan’s internationalization.

The prudence of China’s monetary policy is due to its macroeconomic policy adjustment, with this year’s focus on supplyside reform. Aside from that, the country’s financial and stock markets are committed to strengthening supervision and closing loopholes. In contrast, its monetary policy is playing a small role. Under such circumstances, external factors such as the expectation of a Fed interest rate rise are increasingly unlikely to affect China.

The Fed has no better way out than to increase interest rates and wait for the economy to be resuscitated. Dragged by the gloomy world economy, the U.S. economy has failed to turn itself around, and the Fed’s dithering has turned into an object of ridicule. On the other hand, while the United States’ major trading partners adopt loose monetary policies, raising the interest rate may result in the decline of the nation’s competitiveness in exports. Hence, the Fed is waiting for the economy to recover organically, yet the current trend has fallen short of Yellen’s expectation. Now, she must send out signals that the Fed will raise the interest rate. Otherwise, the U.S. economy will be less popular to the global market.

Since the time of the Fed’s rate hike has not been decided, emerging markets, including China, still have time to cope with market risks such as capital outflow.

Moreover, though Yellen said there is more expectation of an interest rate increase within the year, she maintains that the Fed still only intends to pursue a gradual increase, which indicates that the interest rate rise may fail to materialize. In addition,the U.S. presidential election also has an impact on the Fed’s move. The influence of Republican candidate Donald Trump on the expectation of an interest rate increase is still uncertain.

The Fed is no longer able to dictate U.S. monetary policy as independently as it did during the financial crisis. In the post-crisis era, America’s monetary policy is closely linked to the global market, which requires the country to respect the new order—no one can manipulate the global market by themselves. ■

Since the time of the Fed's rate hike has not been decided, emerging markets, including China,still have time to cope with market risks such as capital outflow

This is an edited excerpt of an article written by Zhang Jingwei, a guest researcher at the Chongyang Institute for Financial Studies at the Renmin University of China,and published in the National Business Daily Copyedited by Dominic James Madar Comments to yushujun@bjreview.com

NUMBERS

($1=6.7 yuan)

290%

Year-on-year profit growth of Zhongjin Gold Corp. Ltd., one of China’s leading gold producers, in the first half of the year

5.72 bln yuan

Revenue of Wanda Cinema Line Co. Ltd.,China’s largest cinema chain, in the first half of the year, up 64.12 percent year on year

384%

Year-on-year profit increase of BYD Co. Ltd.,a major Chinese new-energy vehicle manufacturer, in the first half of the year

$22.5 bln

Deficit of China’s trade in services in July

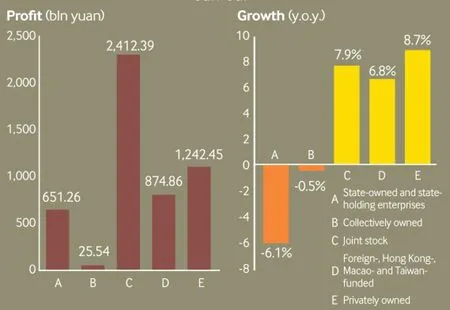

Industrial Enterprises’ Profit and Growth By Business TypeJan-Jul

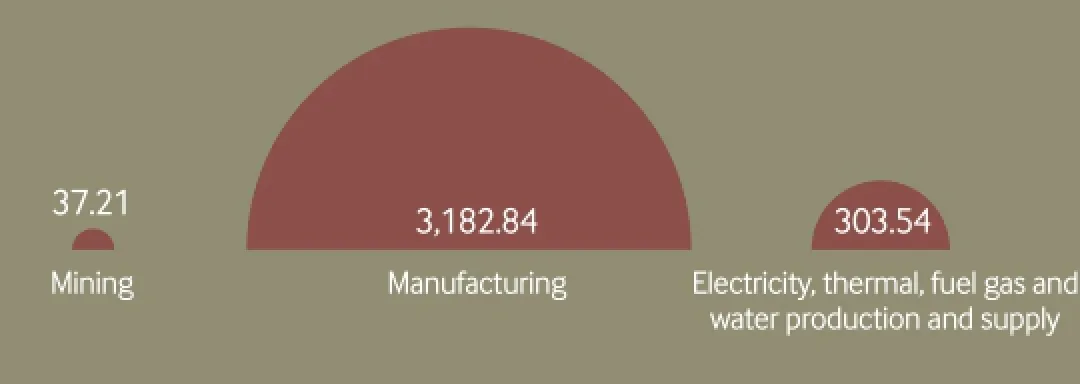

Industrial Enterprises’ Profit by SectorJan-Jul (bln yuan)

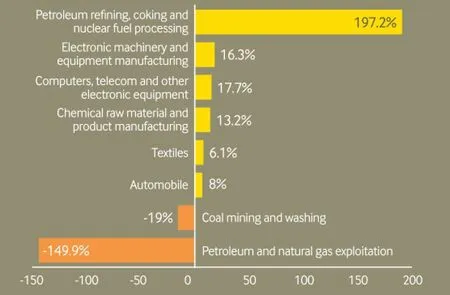

Profit Changes for Major Industrial Sectors Jan-Jul (y.o.y.)

105.05 bln yuan

Net profits of the Agricultural Bank of China, the country’s fourth largest lender, in the first half of the year,up 0.5 percent year on year

91

Number of China’s major water projects under construction, with total costs reaching 800 billion yuan

7.3%

Year-on-year decrease of China’s rail freight volume in the first seven months of the year

90%

Year-on-year profit decline of Shanghaibased shipbuilder CSSC Holdings Ltd. in the first half of the year