MARKET WATCH

MARKET WATCH

OPINION

A Peek Behind the Deficit

China’s capital and financial account slipped into the red with a deficit of $71.4 billion in the second quarter of 2012. What caused the heaping sums of deficit? And does it indicate a flight of capital from China?

I think the capital account deficit is not being caused by massive capital withdrawal, but is the result of domestic institutions and individuals’increased holdings of the U.S. dollar.

In previous years, Chinese companies were reluctant to possess foreign currencies because of the yuan’s one-way appreciation expectations in the foreign exchange market and the yuan’s higher return rate than any other currencies. This has led to a trend of yuan-denominated assets and foreign currency-denominated debts. However, after the yuan’s value began to level off and there were even depreciation expectations for the currency, an opposite trend has appeared.

According to statistics on cross-border transactions by domestic companies and individuals, net capital inflows appeared in the first half of 2012, totaling $77.6 billion. In the first half of 2012, the foreign exchange sale and purchase by domestic companies and individuals had a $29.5-billion surplus, far less than the surplus of crossborder transactions—$79.1 billion. This means that domestic companies and individuals are more willing to purchase the U.S. dollar, gradually leading to the trend of yuan-denominated debts and foreign currency-denominated assets.

Why did this reverse trend occur? Considering the external environment, the sluggish global economy has yielded a dollar shortage. Central banks of all countries are accelerating their restructuring of foreign exchange reserves by buying U.S. dollars. But the currency still has a huge shortage, much higher than the $400 billion in 2008.

From the domestic environment, the more important reason lies in the structure of China’s external balance sheet. China has $2 trillion in net foreign assets. Government departments have $3.2 trillion reserve assets while non-government institutions have $1.2 trillion foreign debts, an equivalence of nearly 20 percent of China’s GDP. This will cause a long-term problem: As long as turmoil occurs in the international financial market, China will face depreciation of the yuan and a massive capital outflow.

As a matter of fact, with the potential for the yuan to appreciate, Chinese importers that have to pay in U.S. dollars are apt to borrow from banks rather than purchase the dollar. In this way, they can gain from a high deposit rate of the yuan and from the appreciation of the yuan. In recent years, due to the strong expectation on yuan’s appreciation and the promotion of yuan settlement in cross-border trade, companies and banks have built a short position in the U.S. dollar—around $200-300 billion. However, with increasing market expectation of U.S. dollar’s appreciation and yuan’s depreciation, more and more companies increased their holdings of the U.S. dollar and sold out the yuan.

Domestic companies and institutions have thus purchased more foreign assets and China’s central bank is forced to withdraw the yuan liquidity, ending up with a certain degree of monetary squeeze and the decline of basic money supply. As the yuan counterparts of foreign exchange reserves are a main source of money supply, the heaping sums of deficit in the capital account will cause the decrease in the yuan counterparts of foreign reserves, thus ending up with the decline of domestic money supply.

Therefore, the huge deficit in the capital account is not caused by capital flight from China, but the hidden structural risks behind the phenomenon should arouse our attention.

THE MARKETS

Closer Cooperation

A press conference promoting the China-Malaysia Qinzhou Industrial Park was held in Beijing on August 8. The park, located in Qinzhou, Guangxi Zhuang Autonomous Region, is the first between the Chinese and Malaysian governments. Covering a planned area of 55 square km, it will become a highlight in China’s future cooperation with Malaysia and with ASEAN.

“The bilateral trade between China and Malaysia totaled $90 billion in 2011, a 21.3-percent year-on-year increase. Malaysia has been China’s biggest trade partner in ASEAN for four consecutive years while China is Malaysia’s biggest trade partner in the world,”said Bai Lichen, Vice Chairman of the 11th National Committee of the Chinese People’s Political Consultative Conference.

The industrial park will focus on six major industries: equipment manufacturing, electronic information, food processing, new material, biotechnology and modern service. Lots of preferential policies have been designed for investment in the park, said Zhang Xiaoqin, Secretary of the Qinzhou Municipal Committee of the Communist Party of China.

Profit Rises

China Vanke Co., the country’s largest property developer by market value, saw net profits increase 25.1 percent year on year to 3.73 billion yuan ($585.6 million) in the first half of the year, according to a statement filed to the Shenzhen Stock Exchange. Its revenue jumped 53.7 percent to 30.72 billion yuan ($4.83 billion).

In the first six months, it sold 6.03 million square meters of housing, with the sales value reaching 62.54 billion yuan ($9.84 billion).

“More projects will be put on sale in the second half, and it’s highly likely that the company’s sales will beat last year’s, provided there are no big changes in the market environment,” said Tan Huajie, Vanke board secretary.

This is an edited excerpt of an article by Zhang Monan, an associate researcher with the State Information

Center, published in Economic Information Daily

- Beijing Review的其它文章

- A New Platform for Service Trade

- The Right Move

- Facing Up To Risks Despite its economic success, concerns linger about whether China will continue to maintain sustainable development

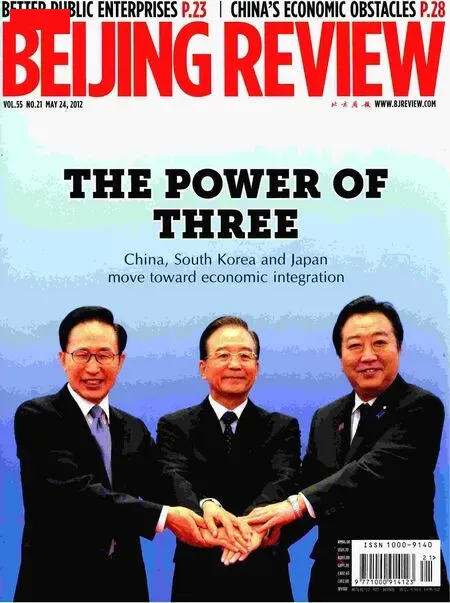

- THREE'S COMPANY CHINA, SOUTH KOREA AND JAPAN CONSIDER FREETRADE AGREEMENT

- Getting Lost in Chinese Menus