THROTTLING DOWN

Rising domestic spending easing effect of sluggish exports on China’s economy By Hu Yue

COVER STORY

THROTTLING DOWN

Rising domestic spending easing effect of sluggish exports on China’s economy By Hu Yue

Despite the weakness of Western economies, the Chinese economy still achieved a robust growth rate of 9.2 percent in 2011. The GDP totaled 47.16 trillion yuan ($7.45 trillion) last year, said the National Bureau of Statistics(NBS).

But the growth rate is lower than the 10.3 percent of the previous year. Also, in the last quarter of 2011, the GDP growth dropped to 8.9 percent from 9.7 percent, 9.5 percent and 9.1 percent, in the fi rst, second and third quarters.

“The quarter-by-quarter weakening was partly due to our economic rebalancing, but it’s in line with the government’s macro-control goals,” said Ma Jiantang, Commissioner of the NBS. The fourth-quarter growth rate remains within a reasonable range, he said.

Yao Jingyuan, a researcher with the Councilor’s Of fi ce of the State Council, said the economic slowdown is not necessarily a bad omen for China.

“It is an acceptable outcome as the economy tries to transform its growth model,” said Yao. “And it’s time to address the imbalance problem glossed over during past boom times.”

“The slowdown is moderate and controlled, and is necessary for curbing in fl ation and restructuring the economy,” said Zhang Xiaojing, a researcher with the Chinese Academy of Social Sciences (CASS). “It also indicates that the country has sped up the transition from quantity-oriented growth to quality-led development.”

Despite the slowdown, the fundamentals for the country’s stable and relatively fast economic growth in the medium to long term haven’t changed, said Ma. The economy still has deep growth potential thanks to ongoing urbanization, industrialization and market reforms.

Li Wei, President of the Development Research Center under the State Council,agreed.

“Two major drivers are helping to inject fresh steam into the economy: continued urbanization that creates enormous domestic demand and industrialization that requires robust investments,” Li said.

“For the economy in 2012, we should stillbe full of confidence,” said Ma. China will maintain its proactive fiscal policy and prudent monetary policy this year.

Driving forces

Since exporters took a heavy blow from sluggish Western economies, China’s economic growth was predominantly homegrown last year.

Buoyant investment helped put a solid floor under economic growth. Investment in fi xed assets surged 23.8 percent from the previous year to reach 30.19 trillion yuan ($4.77 trillion) in 2011, which contributed 54.2 per-cent to last year’s GDP growth, said the NBS.

TO BE SAILING: Cargo ships being built in Nanjing, Jiangsu Province

Meanwhile, Chinese consumers have opened up their wallets to fi ll in the blank left by falling exports. While consumption accounted for 51.6 percent of last year’s GDP,the contribution of net exports was -5.8 percent, according to the NBS.

Retail sales of consumer goods stood at 18.12 trillion yuan ($2.86 trillion) in 2011,rising 17.1 percent compared with 2010.

Zuo Xiaolei, chief economist with the Beijing-based China Galaxy Securities Co.Ltd., said the rapid expansion of the middle class and their increased spending could give the economy a boost, despite a prolonged downturn in Europe and the United States.

Per-capita disposable income of China’s urban residents climbed 14.1 percent year on year in 2011 to reach 21,810 yuan ($3,445),while per-capita net income of farmers was 6,977 yuan ($1,102), up 17.9 percent year on year, according to the NBS.

“Since it takes time to complete the social safety net, the road to a consumer-oriented growth model will depend critically on real wage growth,” she said.

The Ministry of Human Resources and Social Security said 24 provinces raised the minimum wage standard by an average of 22 percent last year.

In September 2011, the government raised the cut-off point for personal income tax to 3,500 yuan ($553) from 2,000 yuan ($316),which facilitated wage growth and boosted consumption.

Progress in improving social security could also help fuel consumption.

A pension program benefiting the country’s 50 million unemployed urban residents that launched on July 1, 2011 has been implemented in 60 percent of the cities and townships.

Promising prospect

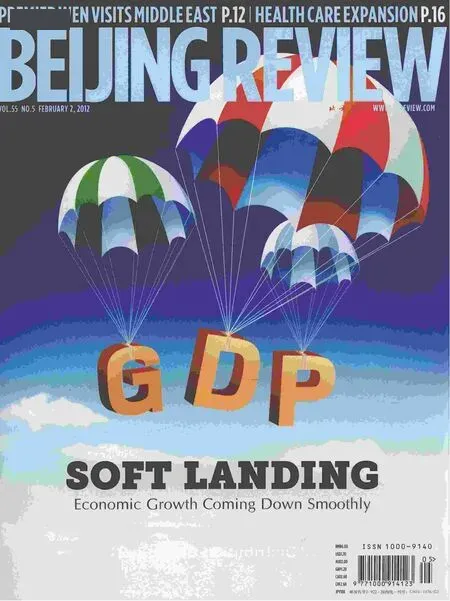

Although a downward trend of GDP growth is inevitable due to external uncertainties and domestic rebalancing, China’s economy will continue steering a steady course of growth.

In fl ation, an acute headache for China in 2011, will calm down.

“Consumer prices will taper off markedly in 2012 as the economy slows, food prices retreat and imported inflation falters,” said the Bank of China in a recent report, which predicted that the CPI will rise around 3.5 percent in 2012.

Zhuang Jian, chief China economist with the Asian Development Bank, also anticipated a downward trend in the overall price level in 2012 as a result of diminishing carry-over effects and the government’s prudent monetary policy direction.

“There might be a certain degree of fl uctuation in monthly fi gures, but the overall CPI growth will stay around 4 percent,” he said.

Investment remains a pillar contributor to the macro-economy, said Qu Hongbin, chief China economist with the HSBC.

“China can use affordable housing and public welfare projects as a powerful buffer to offset the slowdown in private property,” he said, adding that it has already begun.

Fan Jianping, a researcher with the State Information Center, agreed. “An expected slowdown in commercial housing construction will be compensated by the government’s ambitious affordable housing plans,” said Fan.

“Investments will remain supported by solid corporate profits and gradually easing monetary environment,” said Lu Zhengwei,chief economist with the Industrial Bank Ltd.

“Infrastructure construction is likely to slow this year due to decreased spending on railways,” said Lu. The Ministry of Railways recently announced that China plans to invest 400 billion yuan ($62.99 billion) on railway infrastructure construction in 2012, representing a slight decline from the 469 billion yuan ($74.1 billion) in 2011.“But massive input in water resources and energy development are already in the pipeline,” he said.

Qu said a new driver will be the strategic emerging industries, including information technology and new materials. “A key target in the 12th Five-Year Plan (2011-15), was to boost those industries to account for 15 percent of GDP by 2015,” he said.

In its Global Economic Prospects 2012 released on January 18, the World Bank predicted the Chinese economy will grow 8.4 percent in 2012 and 8.3 percent in 2013.

China is vulnerable to downturns in the United States and Europe, but a healthy balance sheet, slowing inflation and massive foreign reserves mean China can ease aggressively, if necessary, said the Bank of America Merrill Lynch, in a recent report.

The bank expected China to avert a hard landing and forecasts GDP growth of 8-9 percent in 2012.

“Affordable housing will be a crucial factor in restarting the growth engine. We don’t doubt the Chinese Government’s determination in building more affordable housing,” said Lu Ting, a Hong Kong-based economist with the Bank of America Merrill Lynch.

Dong Tao, chief regional economist for non-Japan Asia at Credit Suisse, expected a soft landing in China as private consumption holds up because of salary increases, tax cuts and continued urbanization. He predicted quarterly growth in 2012 will be about 8-8.5 percent.

“If the economy weakens any further, we would expect future stimulus to be more focused on consumption than infrastructure. In the beginning, a fi scal stimulus would likely increase funding for affordable housing and provide consumption subsidies,” he added.

Wang Tongsan, Director of the Institute of Quantitative and Technical Economics at the CASS, said China has better fiscal and financial resources than major developed economies, so it can avoid a balanced recession.

Wang expected this year’s economic growth is likely to be 8-9 percent and CPI will be controlled within 4 percent.

This year’s growth might be the lowest since 2003, but it would still be the world’s fastest among large economies, said Wang.

Potential risks

The greatest risk for China this year is external, as the European debt crisis is likely to deteriorate, causing further pains for Chinese exporters, said Peng Wensheng, chief economist at the China International Capital Corp.

Wang Tao, chief China economist with the Swiss investment bank UBS, also struck a note of caution. Wang expected China’s export growth to drop to zero in 2012, which would trim 1.4 percentage points off GDP growth, although she does not think the trade surplus will completely vanish in 2012.

“But looking from a global perspective,the shrinking trade surplus should be seen as a welcome development, an evidence that China has made progress in redressing trade imbalance,” she added.

SUFFICIENT SUPPLY:Residents in Luoyang,Henan Province, buy vegetables at a community market

“The export situation will be grim in 2012, especially in the fi rst half of the year,”said Zhang Xiaoqiang, Vice Chairman of the National Development and Reform Commission, at a recent forum held in Beijing.

Zhang expected China’s foreign trade to grow 10 percent in 2012, much slower than the 22.5 percent in 2011.

Shen Jianguang, Greater China chief economist at Mizuho Securities Asia Ltd.,believed another cause for concern lies in the rapidly cooling property markets.

“Stagnating property investments have sent a chill throughout relevant industries such as appliances and cement,” he said. “Meanwhile, lagging land sales are making a dent to fi scal capacities of local governments.”

“Other risks looming over the economy include growing debts of local governments and rampant private lending,” said Zhu Baoliang, a researcher at the State Information Center.

“Properly dealing with those problems will be key to economic stability this year,”he said.

To soothe abounding growth worries,policymakers have cautiously handed out incentives on a selective basis, including favorable policies for smaller businesses in terms of credit support, taxation and government purchases.

On November 30, 2011, the central bank announced plans to decrease the ratio of deposits that banks must set aside in reserve by 0.5 percentage points for the fi rst time in three years.

“Waning in fl ation has allowed the country to stop tightening monetary policy, but the speed and format of further loosening will largely depend on how domestic and overseas situations develop,” said Guo Tianyong,Director of the Research Center of China’s Banking Industry, Central University of Finance and Economics.

“Despite falling CPI, long-term inflation pressures remain, forcing policymakers to keep a vigilant eye on consumer prices,” said Fan.

Fan noted that domestic in fl ation will be an inevitable trend, as resource prices, labor costs, and land prices head north. “China’s broad money supply is almost two times that of the GDP, the highest ratio among major global economies. The excess liquidity may easily reignite in fl ation once regulatory controls become loose,” he said.

“The United States is also likely to start a third round of quantitative easing, paving way for China’s in fl ation to come back,” he added.

Fan suggested China strengthen supplies of agricultural products by improving farming technologies, logistics ef fi ciency and rural fi nance.

“On the liquidity front, there is limited room for policymakers to aggressively ease the monetary policies,” he said.

Wang Jian, Secretary General of China Society of Macroeconomics, said it is too early to lower the guard against inflation as the Lunar New Year spending may trigger a rebound in food prices.

“The persistent con fl ict between expanding population and shrinking arable land will push up grain prices,” he said. “International commodities prices are also likely to bounce back due to recovering demand in emerging economies.”

“Those factors may drive CPI back to no less than 5 percent this year, and possibly above 6 percent in the fourth quarter,” he added.