MARKET WATCH

Credit Slowdown

Bank lending is tapering off in China,which will relieve inflationary pressures affecting the economy.

New loans denominated in the yuan totaled 492.6 billion yuan ($76.4 billion) in July, the least monthly increase this year,representing a decrease of 25.2 billion yuan($3.9 billion) from a year ago, said the People’s Bank of China, the central bank.

The broad money supply (M2), which covers cash in circulation and all deposits,increased 14.7 percent year on year to 77.29 trillion yuan ($12 trillion) at the end of July.The growth rate was down from June’s 15.9-percent increase and well below the government’s target ceiling of 16 percent for the entire year.

“The less-than-expected lending showed the country’s efforts to soak up liquidity is bearing fruit,” said Lian Ping, chief economist with the Bank of Communications Ltd.

To tame soaring consumer prices, the central bank raised the benchmark interest rates three times this year, and hiked the reserve requirement ratio six times, punching the banks’ ability to lend.

Unless the economy significantly weakens or inflation abates, policymakers are less likely to ease their monetary stance, said Peng Wensheng, chief economist with the China International Capital Corp. Ltd.

“The Chinese economy is only moderating, not slumping,” said Qu Hongbin, a Hong Kong-based economist with the HSBC.“There is no need to worry about over-tightening or an economic hard landing.”

As a result, the country is less likely to alter its monetary tightening stance any time soon, despite ongoing jitters in global financial markets, he said.

Buying U.S. Assets

China increased its holdings in U.S.Treasury securities by $5.7 billion in June for the third straight month, after five consecutive months of declines, said the U.S. Treasury Department. China retained its position as the largest foreign holder of the securities with$1.1655 trillion in its portfolio.

Domestically, many fret over the safety of China’s U.S. Treasury holdings due to weakness of the U.S. economy and growing government indebtedness. For the first time in history, Standard & Poor’s on August 5 lowered the rating on the U.S. sovereign debt from AAA to AA+, and also left open the possibility of a further downgrade if U.S.economic health worsens.

China adjusts its holdings according to market situations, said the State Administration of Foreign Exchange. But it is still necessary for the U.S. Government to safeguard interests of investors and take measures to boost financial market con fidence.

Ma Jun, a Hong Kong-based economist with Deutsche Bank, said he believed the feasibility of shifting to other investments is very limited for China.

“Either some markets are too small or those markets are bigger risks than the U.S.Treasury,” he said. “Moreover, any significant selling by China of U.S. dollar assets would be noticed by global markets and could spark panic selling of dollar reserves on a grand scale.”

SOEs Falter

China’s state-owned enterprises (SOEs)are facing headwinds due to acute cost inflation.

In the first seven months of 2011, SOEs raked in a combined profit of 1.34 trillion yuan ($207.1 billion), growing 24.4 percent from the previous year, said the Ministry of Finance (MOF). Of this total, central SOEs earned 909.5 billion yuan ($141 billion),with the remainder going to local SOEs.

But in July alone, SOEs’ pro fits dropped 5 percent from June, representing the biggest month-on-month decrease so far this year.

SOEs’ revenues totaled 20.65 trillion yuan ($3.2 trillion) from January to July, up 25.2 percent from a year ago. But the figure for July went down 5.3 percent from June.

The SOEs also suffered a decrease in pro fitability as their pro fit-to-sales ratio came in at 4.8 percent, 0.1 percentage point lower than the same period last year. The worst performers in July were machinery, steel and chemical sectors, which experienced a slump in pro fits, said the MOF.

Cao Jianhai, a researcher with the Institute of Industrial Economics of the Chinese Academy of Social Sciences, said the profit gloom is in part due to the relatively high comparison base of last year.

“Meanwhile, costs inflation is eating into their pro fit margins, and a slowdown in railway investments has also curbed demands for their products,” he said.

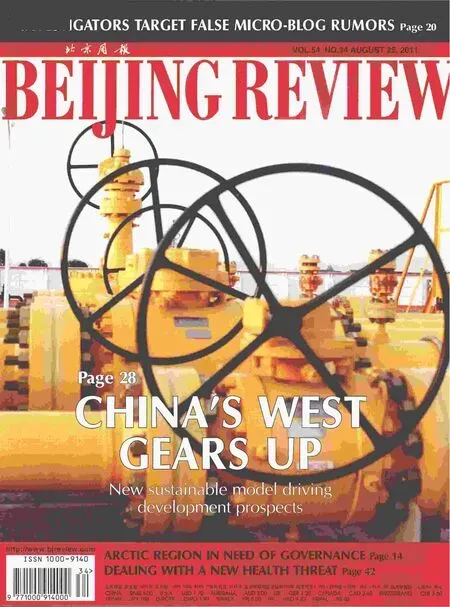

POWERING TIBET: The Golmud Liquid Natural Gas Plant in Qinghai Province is expected to come into operation on October 15. The plant will provide natural gas to the neighboring Tibet Autonomous Region, delivering a boost to the region’s economic development

Numbers of the Week

$69.19 billion

434.9 billion kwh

China’s power consumption went up 11.8 percent from a year ago to reach 434.9 billion kwh in July, said the National Energy Administration.

Huawei Booms

Huawei Technologies Co. Ltd., China’s largest mobile network equipment maker,reaped juicy returns in the first half due to robust device sales.

The Shenzhen-based company reported 98.3 billion yuan ($15.2 billion) of sales revenues in the first half of this year, rising 11 percent year on year. The operating profits totaled 12.4 billion yuan ($1.9 billion).

While it still relies on network equipment businesses as a major source of income, Huawei has been making a push into consumer devices because of buoyant global demands for smart phones and tablets.

Huawei Device, the division that sells cellphones, wireless cards and tablets, posted a 40-percent increase in shipments to 72 million units for the first half, with global sales revenues up 64 percent at $4.2 billion.

That $4.2 billion translates to a 28-percent contribution to total first-half sales, up from less than 20 percent in the same period last year.

“Although the global economy continues to face uncertainties, we remain con fident in achieving our annual sales target of 199 billion yuan ($31 billion) with our device and enterprise businesses as new growth drivers.” said Cathy Meng, chief financial officer of Huawei.

In addition, a pickup in spending by Chinese telecom carriers such as China Mobile, China Unicom and China Telecom,could also boost Huawei’s performance in the second half.

“Some of the major telecom projects in China that were planned for this year were delayed to the second half,” said Kelvin Ho,an analyst at Yuanta Securities Co. Ltd. in Shanghai.

Expanding Globally

Chinese enterprises are set to boost their outbound investments by double digits in the second half of this year, which may make 2011 a record year for Chinese merger and acquisition (M&A) activities abroad, said the accounting firm PricewaterhouseCoopers(PwC) in a recent report.

There were a record 107 outbound M&As as of June this year, an increase of 14 percent from a year earlier. This frenzy indicated that China remains hungry for M&A deals abroad across a wide range of industries, despite market volatility and an uncertain global economic outlook.

“There may be further deals in resources in the latter half, although a second global financial crisis could stall some deals in the pipeline. Such a downturn, however, could also offer buying opportunities for China,”said Roger Liu, PwC Transaction Service Group Partner.

“Investment in know-how, technology and brands is growing in importance,” Liu said.

While Asia remains the top destination for Chinese outbound M&As with 33 deals in the first half of this year, there is a noticeable increase in Europe as an investment target with 30 announced transactions in the first half, exceeding the region’s total in 2010. In addition to the popular resources sector, the target sectors in Europe are the industrial and the retail sectors, said the PwC report.

Meanwhile, Chinese firms are also becoming more risk-sensitive in seeking overseas deals. Patrick Zeng, head of Financial Lines & Surety at Zurich Financial,said more Chinese businesses are seeking M&A insurance before pursuing a deal. ■