Worries at Hand

By MEI XINYU

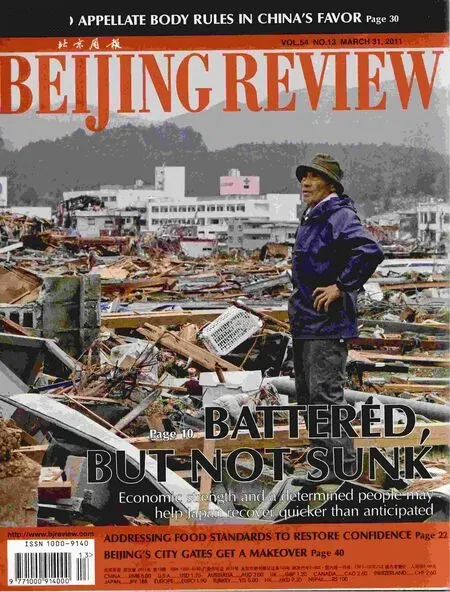

Japan’s earthquake shakes the global economy

The recent massive earthquake in Japan—a highly advanced economy in terms of industry,exports and assets—is having a sweeping impact on the global economy.

The biggest impact on the real economy has been production suspension and price hikes caused by the earthquake. Japan is the world’s major provider of intermediate inputs and manufacturing equipment in the advanced manufacturing sector,especially in automobiles and electronics products. Unfortunately, the electronics industry was the one hit most severely this time.

Though Japan’s two key economic regions, Tokyo-Yokohama and Osaka-Kobe,are not in the quake-damaged area, the region most severely hit by the earthquake is Japan’s less developed northeastern part—these areas will be unable to restore production in the near future. Continued aftershocks, damaged infrastructure, blackouts and radiation leaks in the Fukushima nuclear plant have all hindered their recovery.

In the electronics industry, Japan’s electronics materials represent more than 70 percent of the world’s total market share. A number of electronics factories,though not the major production bases, are located in the quake-damaged areas. They are facing a long production standstill.Others, though not located in the quakedamaged areas, will also have to operate below capacity, due to blackouts caused by the crisis at the Fukushima nuclear plant.

Japan boasts the world’s biggest producer of anisotropic conductive film(ACF), a material commonly used in liquid crystal display (LCD) manufacturing.Hitachi Chemical Co. Ltd. alone occupies more than 50 percent of the world’s total market share and provides more than 40 percent of the ACF used by the world’s top five panel producers, namely Samsung,LG, AUO, CMO and Sharp. If the company stops producing, it will be a disaster for the world’s panel market.

Japanese companies Shin-Etsu and SUMCO supply more than 50 percent of the world’s semiconductor silicon wafers.There are 18 wafer companies in the severely quake-hit areas, including Miyagi,Iwate, Akita and Fukushima. They produce about 390,000 wafers per month, 4 percent of the world’s monthly output.Shin-Etsu, the world’s largest supplier of semiconductor materials, has a factory near the damaged area. Though SUMCO’s base is in Kyushu, which was safe during the quake and tsunami, its material supply chains were also affected. As a result,the world’s semiconductor producers are forced to seek wafers from non-Japanese firms, and the price of wafers is rising correspondingly.

Japan is also a major supplier of processing equipment for semiconductors and displays. In particular, the world’s lithography equipment, except for that from ASML of the Netherlands, is all from Japanese companies, including Nikon, Canon and NSK. Nikon’s precision machinery factories, which produce photo exposure machines, are located in quake-damaged Miyagi and Tochigi. Canon’s factories that produce exposure equipment for semiconductors and displays are located in Tochigi and Ibaraki, areas both severely hit by the earthquake.

No doubt, the facts listed above fully show Japan’s leading position in the world’s advanced manufacturing sector.Due to the shortage of Japanese-made parts, three of General Motors’ factories,in the United States, Germany and Spain,respectively, have temporarily stopped production. The monthly output of French car maker Renault’s joint venture in South Korea will also be reduced by 15-20 percent. Key components of the iPad2 and Boeing 787 are all facing tight supply.

The author is an associate research fellow with the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce

Even those industries that have not suffered actual losses are facing price rises due to panic. Take the memory market for instance. Japan’s two biggest memory makers, Elpida (producer of DRAM) and Toshiba (producer of NAND Flash), have their production bases in southern Japan’s Hiroshima and central Japan’s Nagoya,respectively. The two places were hardly affected by the earthquake. But on the day after the earthquake, almost all memory dealers stopped offering price quotes, and traders began to hoard goods. Currently, in the retail and wholesale markets of China and other major countries, memory prices have surged. Some rose by more than 20 percent two or three days after the quake.

To compensate for the shortage of Japanese-made parts, many companies in the world will turn to suppliers in other countries and regions. Thus, countries like China may gain new momentum to develop advanced manufacturing industries, to replace imports from Japan.

In addition, to strive for punctual delivery to maintain or even improve their business integrity, many Japanese companies will shift part of their production to factories overseas. They will also accelerate shifting their production capacity to other countries with mature conditions.This will trigger a new round of industrial chain restructuring in East Asia.

In the foreign exchange market, the earthquake has also greatly affected the exchange rate of the Japanese yen. For countries with few foreign assets, such a big earthquake, in addition to causing great damage to actual production capacity and wealth, is tremendously bad news for the value of their currencies.

For Japan, with its large amount of foreign assets, especially many overseas investments by insurance companies,the earthquake brought good news to the Japanese yen in the near term. Many people predict Japanese insurers will sell their foreign assets and buy the Japanese yen in preparation for compensation after the earthquake, and other Japanese companies may sell their foreign assets to make up for the losses and cope with reconstruction.

But the fact is that many Japanese companies are considering shifting at least part of their production capacity overseas and reducing the scale of reconstruction, or even giving up reconstruction. As a result,the prediction will fall through.

After a short wave of appreciation in the yen’s value caused by market predictions, the earthquake’s damage to the foundation of the Japanese economy will ultimately show up in the yen’s exchange rate.

In the commodity markets, the shortterm and medium-term effects of the earthquake will also go in a different direction. Unlike the effects on the yen, it will first be bad and then turn good. Also, there will be potential inflation pressure.

Large-scale production suspension in Japan, an industrial power, means a sharp drop in the demand for energy and minerals. It is estimated that the halt in production by Japanese steelmakers will decrease demand for seaborne iron ores by 22 million tons. Iron ore prices dropped sharply from $200 per ton to $170 per ton within two trading days. Even if the market predicts large steel demand from Japan’s after-quake reconstruction, investors and traders still have not fully restored their con fidence in iron ore prices.

However, with the unfolding of afterquake reconstruction, prices of certain commodities will probably rise, especially oil prices. If anti-nuclear voices raised by Japan’s nuclear plant crisis grow loud enough and many countries plan to halt their nuclear power development plans, oil prices will surely go up.

In flation pressure also comes from the large-scale capital injection from Japan’s central bank. The March 14 monetary policy meeting alone decided to inject 18 trillion yen ($222 billion) into the shortterm monetary market, Japan’s biggest ever emergency injection of funds to stabilize the financial markets. The meeting also decided to temporarily inject 41 billion yen($506 million) into branch banks across Japan. Following that, a series of new funding measures were carried out.

In 2008-09, the peak of the global financial crisis, forceful anti-crisis measures taken by many countries planted the seed of global inflation and asset bubbles in emerging markets beginning in 2010. So, what effects will Japan’s emergency measures have on inflation? Japan has long been a major capital-exporting country in the world’s financial market. Its massive capital injection will inevitably flow to other countries. This is only a matter of time. ■