Proceed With Caution

By LAN XINZHEN

Proceed With Caution

By LAN XINZHEN

China adopts security review system for foreign mergers and acquisitions of domestic companies

China’s Ministry of Commerce(MOFCOM) recently gave Nestle the nod of approval for the international food giant’s acquisition of Yinlu Food Group. A signing ceremony was held on September 8 in Xiamen, southeast China’s Fujian Province, where Yinlu is headquartered. This is the first merger and acquisition (M&A) case of a domestic enterprise by a foreign investor since the Provisions on the Safety Review System for M&As of Domestic Enterprises by Foreign Investors came into effect on September 1,2011.

Nestle, the largest food and nutrition company in the world, has been accelerating its development in the Chinese market in recent years. On April 18, 2011, it announced plans to purchase a 60-percent stake in Yinlu,a family-owned food maker with sales of 5.46 billion yuan ($854 million) in 2010. The deal was submitted to MOFCOM’s for anti-monopoly review on May 24 and was approved after a three-month review period.

In July, the food conglomerate said it would buy a 60-percent stake in leading Chinese confectioner Hsu Fu Chi International. MOFCOM’s approval of the deal is still pending.

Before the safety review provisions were issued, relevant ministries regulated foreign investors’ M&A transactions through regulating the access of foreign investment and anti-monopoly investigations. Under the provisions, security reviews will be launched for deals involving national defense, the national economy and impacts on society, as well as research and development of technologies key to national security.

Western model

Western countries are the true forerunners of safety reviews for M&As involving foreign investors with countries like the United States and Canada operating intricate review systems through legislation and special agencies.

The U.S. review system dates back to the 1987 when the Fujitsu Corp. of Japan sought to purchase U.S.-based Fairchild Semiconductor Corp. from Schlumberger Ltd. of France. The intended acquisition alarmed a number of U.S. officials who viewed it as yet another step in Japan’s efforts to dominate the global semiconductor trade at the expense of U.S. semiconductor firms. The transaction forced the United States to draft the Exon-Florio Amendment,a law enacted by the United States Congress in 1988 to review foreign investment in the United States.

The Byrd Amendment followed in 1992,producing stronger regulatory scrutiny on acquisition bids for a business owned by a foreign government. The Foreign Investment and National Security Act of 2007 raised the level of scrutiny for foreign acquisitions of U.S. corporate entities.

In March 2005, the Chinese National Offshore Oil Corp. (CNOOC) tried to acquire Union Oil Co. of California (Unocal). U.S.congressmen were quick to act. Following a vote in the United States House of Representatives, the bid was referred to then President George W. Bush on the grounds of national security. CNOOC eventually withdrew its bid in August 2005.

Opening-up policy intact

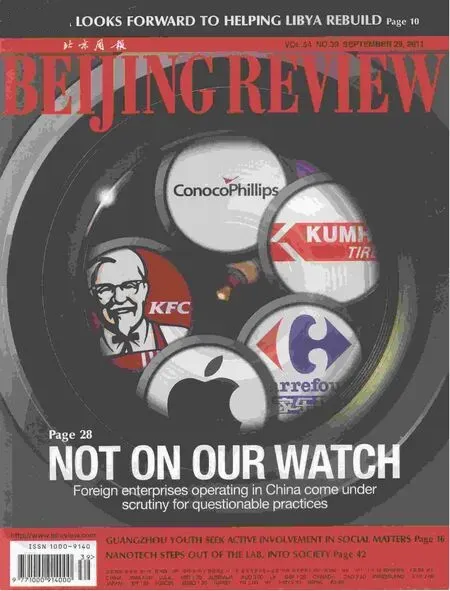

Even though China attracted foreign direct investment of $105.7 billion in 2010, up 17.4 percent from the previous year, foreign companies continued to complain about the safety review system, saying it signaled the Central Government’s efforts to sti fl e foreign investment.

The MOFCOM said that utilizing foreign investment is a vital component of China’s opening-up policy. Establishing the M&A security review system will improve the foreign investment policy and regulatory systems,enhance transparency and predictability, and promote the orderly development of M&As by foreign investors.

China’s M&A security review system complies with the WTO’s security exceptions principle. While China will not change its policies about opening up and utilizing foreign investment, it will strengthen investment cooperation with other countries and build a more liberal multinational investment system and legal environment.

The review system will encourage and standardize M&As by foreign investors and is consistent with China’s earlier policy of diversifying the utilization of foreign investment, said Wang Zhile, Director of Beijing New Century Academy on Transnational Corporations.

On April 6, 2010, the State Council issued a document setting out guidelines on the future development of China’s foreign investment policies. The document supported listed domestic companies introducing strategic foreign investors, and established a standard process for foreign capital portfolio investment and M&As.

No harm to reform

The MOFCOM said that the safety review provisions will help to further China’s opening up. More importantly, it will regulate and promote the healthy development of foreign investment in China.

As the Chinese market matures, foreign M&As of domestic enterprises have increased. China’s anti-monopoly law passed in August 2007 requires foreign companies to pass a national security test when they merge with or acquire a Chinese company that may affect China’s national security.

The provisions are the extension of the anti-monopoly law, said the MOFCOM.

A NICE BUY:A consumer purchases dairy products at the China International Women and Children Industry Expo held in Beijing on July 29-August 1.Nestle’s bid for a 60-percent stake in Xiamen-based Yinlu Food Group has been approved by the MOFCOM

According to the provisions, where M&A of a domestic enterprise by a foreign investor is subject to M&A security review, the foreign investor shall fi le an application for M&A security review with the MOFCOM.When two or more foreign investors jointly make a M&A, an application for M&A security review may be fi led with the MOFCOM by all the foreign investors, or by one foreign investor designated by all the investors.

When a foreign investor merges with or acquires a domestic company and the State Council or related departments believe that a security review needs to be conducted of the

● MOFCOM data show that China absorbed $105.74 billion in FDI in 2010 and M&As accounted for about 3 percent of the total FDI.

● The world’s FDI in 2010 reached$1.12 trillion, more than 70 percent of which was investment through M&As.

● According to the China Merger &Acquisition Report 2010 by Zero2IPO Research Center,Chinese enterprises completed 1,798 M&A deals in 2010, with 30 deals by foreign investors.M&A, they may make proposals for an M&A security review to the MOFCOM and submit explanations with regard to the circumstances in question, and the MOFCOM may request interested parties to submit relevant explanations.

When the transaction is subject to M&A security review, MOFCOM shall submit its recommendations to the Joint Ministerial Panel responsible for reviewing foreign takeovers of Chinese companies within fi ve business days. When the Joint Ministerial Panel believes that the M&A security review is indeed necessary, the MOFCOM will require the foreign investor to fi le an application for M&A security review according to the provisions.

For foreign investors, the provisions do not mean that China is deviating from its opening-up policy, said Hong Tao, a professor with the School of Economics of Beijing Technology and Business University. The provisions aim to prevent monopoly through protecting some domestic brands and enterprises and implementing safety review on foreign investors’ M&As, Hong said.

If foreign investors want to expand product lines, establish production bases and complete assembly lines through M&As,relevant supervisory departments should give them the green light, said Song Hong,a researcher with the Institute for World Economy and Politics of Chinese Academy of Social Sciences.

But China should be alert that some large multinational companies intend to destroy domestic brands with hostile takeovers, said Song.

Compared with previous rules that govern the security review of foreign investors’M&A deals, the new regulation made it clear for the fi rst time that foreign investors are not allowed to avoid the review by any means whatsoever, which includes using the variable interest entities (VIEs) model, a common practice in the Internet sector.

By using the VIE model, Internet companies usually register overseas, thus giving the overseas company real control over its domestic assets.

“The new regulation solved a major loophole in the previous rules by stating that ‘trickery’ and any other means of avoiding the review process are strictly prohibited,” said Mei Xinyu, a researcher at the Chinese Academy of International Trade and Economic Cooperation under the MOFCOM.